Online banking has made life so much easier. No more standing in long queues, filling out forms, or rushing to the bank before closing time. With just a few taps on your phone or clicks on your laptop, you can send money, check your balance, and pay bills from literally anywhere. But to enjoy these conveniences safely, it’s important to follow the best secure online banking practices to protect your personal and financial information.

But with all this convenience comes one big responsibility: keeping your financial information safe. Cybercriminals are always on the lookout for vulnerabilities. That’s why knowing how to stay secure online is non-negotiable.

Here are some practical (and easy!) ways to protect your money when banking online.

1. Use a Safe Internet Connection

First things first—ditch public Wi-Fi when you’re doing anything money-related. Coffee shop Wi-Fi might be great for scrolling Instagram, but it’s not safe for logging into your bank account. Use your home Wi-Fi or a secure VPN connection if you’re on the go. Think of it as locking the door before you go to sleep—it’s basic safety!

2. Create a Strong and Unique Password

Your online banking password should be long, complex, and one-of-a-kind. Mix uppercase and lowercase letters, numbers, and special characters. And please—don’t reuse passwords from other accounts! Better yet, use a password manager to help you keep track of everything securely.

3. Double-Check the Website or App

Before logging into your bank account, take a second to make sure you’re on the right site or app. Check for HTTPS in the URL and look closely at the web address. Scammers often create fake sites that look real but are out to steal your info. Only download banking apps from official app stores—no shady links!

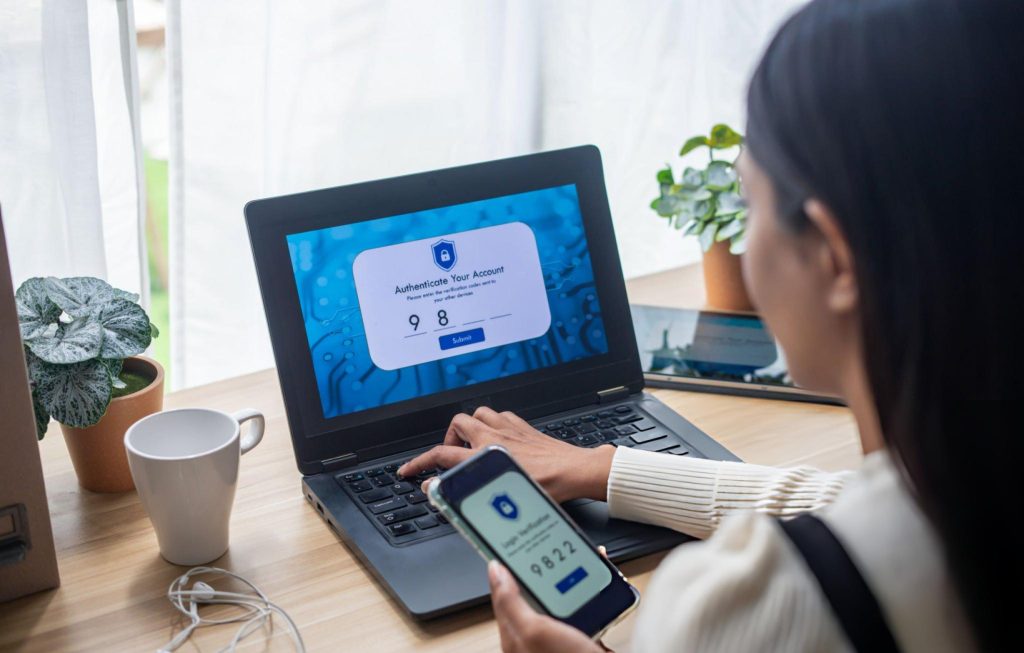

4. Turn On Two-Factor Authentication (2FA)

If your bank offers 2FA, turn it on—like, yesterday. It adds an extra layer of protection by requiring a code sent to your phone or email, even if someone has your password. It’s simple, effective, and can stop cybercriminals in their tracks.

5. Keep an Eye on Your Accounts

Make it a habit to check your account regularly. It only takes a minute to scroll through your recent transactions and make sure everything looks right. Spot something weird? Contact your bank immediately. The sooner you act, the better.

6. Set Up Real-Time Alerts

Most banks let you set up SMS or email alerts for things like transactions, withdrawals, or failed login attempts. These alerts act like your digital watchdog—they let you know the moment something unusual happens.

7. Keep Your Devices and Apps Updated

We get it—those software update notifications are annoying. But they’re also really important. Updates often include security fixes that help protect you from new threats. So don’t ignore them—update your phone, apps, and antivirus software regularly.

8. Watch Out for Phishing Scams

Ever get a message claiming to be from your bank, asking you to click a link or provide personal info? That’s likely a phishing attempt. Be skeptical. Your bank will never ask for sensitive details over email or text. When in doubt, call the bank directly using the number on their official website.

9. Always Log Out

Done checking your balance? Log out—especially if you’re using a shared or public device. Just closing the app or browser window doesn’t mean you’ve ended your session. Logging out properly keeps your account secure.

10. Use Biometric Login (If Available)

Face ID or fingerprint authentication isn’t just convenient—it’s also super secure. If your banking app supports it, turn it on. It makes accessing your account easier for you and harder for everyone else.

Final Thoughts

Online banking isn’t going anywhere. It’s fast, convenient, and fits perfectly into our busy lives. But while the tech keeps getting better, so do the tricks hackers use to try and steal your info.

Staying secure doesn’t have to be complicated. With a few smart habits, you can take control and keep your money safe from digital threats.

At the end of the day, it’s not just about what your bank is doing to protect you—it’s also about what you do. So be proactive, stay alert, and make security a part of your routine.

Stay smart, stay safe—and keep your hard-earned money exactly where it should be: with you.